The U.S. Committee on Financial Services chaired by congresswoman Maxine Waters, and also led by ranking congressman Patrick McHenry, held a historic crypto hearing on Wednesday, Dec. 8th with a panel of blockchain industry leaders answering key questions. In Waters’ opening statement she declares:

This hearing and subsequent hearings will help this committee consider how to support responsible innovation that protects consumers and investors, safeguard our financial system from systemic risk, promote financial inclusion, address environmental contents as well as to consider a central bank digital currency [CBDC]

Considering that the stablecoin Tether’s market cap reached over 75 billion dollars, and there is major uncertainty as to what assets are backing the total amount of Tether in circulation, we are past due a serious congressional debate on crypto. Overleveraged Tether could lead to a crypto market meltdown if Congress does not act; and yet, it is also extremely important for lawmakers to tread carefully, as missteps could hamper the future of burgeoning decentralization.

Considering that the stablecoin Tether’s market cap reached over 75 billion dollars, and there is major uncertainty as to what assets are backing the total amount of Tether in circulation, we are past due a serious congressional debate on crypto. Overleveraged Tether could lead to a crypto market meltdown if Congress does not act; and yet, it is also extremely important for lawmakers to tread carefully, as missteps could hamper the future of burgeoning decentralization.

In McHenry introductory remarks, he posed a significant question to the hearing’s attendees:

Do you know enough about this technology to have a serious debate?… How do we make sure as American policy makers that this cryptocurrency revolution happens in the U.S., and not overseas?

His statement rings true to the frustrations that many crypto enthusiasts have borne throughout the course of blockchain’s history: Regulators and politicians have been too quick to judge cryptocurrency on baseless claims without fully understanding its tech, and also its potential to help those unserved by the current banking system and the existing insecure internet infrastructure.

We are plagued with only the headlines surrounding exchange hacks, ICO scams, and overall anti-regulatory sentiment which vilify the crypto industry and thereby cloud the democratic, transformational aspects of truly decentralized crypto.

In lieu of McHenry’s clarion call for open-mindedness, the hearing’s overall tone was refreshingly optimistic. With a few exceptions, most committee members approached the panel with encouraging questions. There was even noticeable enthusiasm among the committee regarding cryptocurrency’s ability to secure our broken internet, offer solutions for the unbanked and underbanked populations of the world, and to usher in a new era of innovation centered around decentralized blockchains.

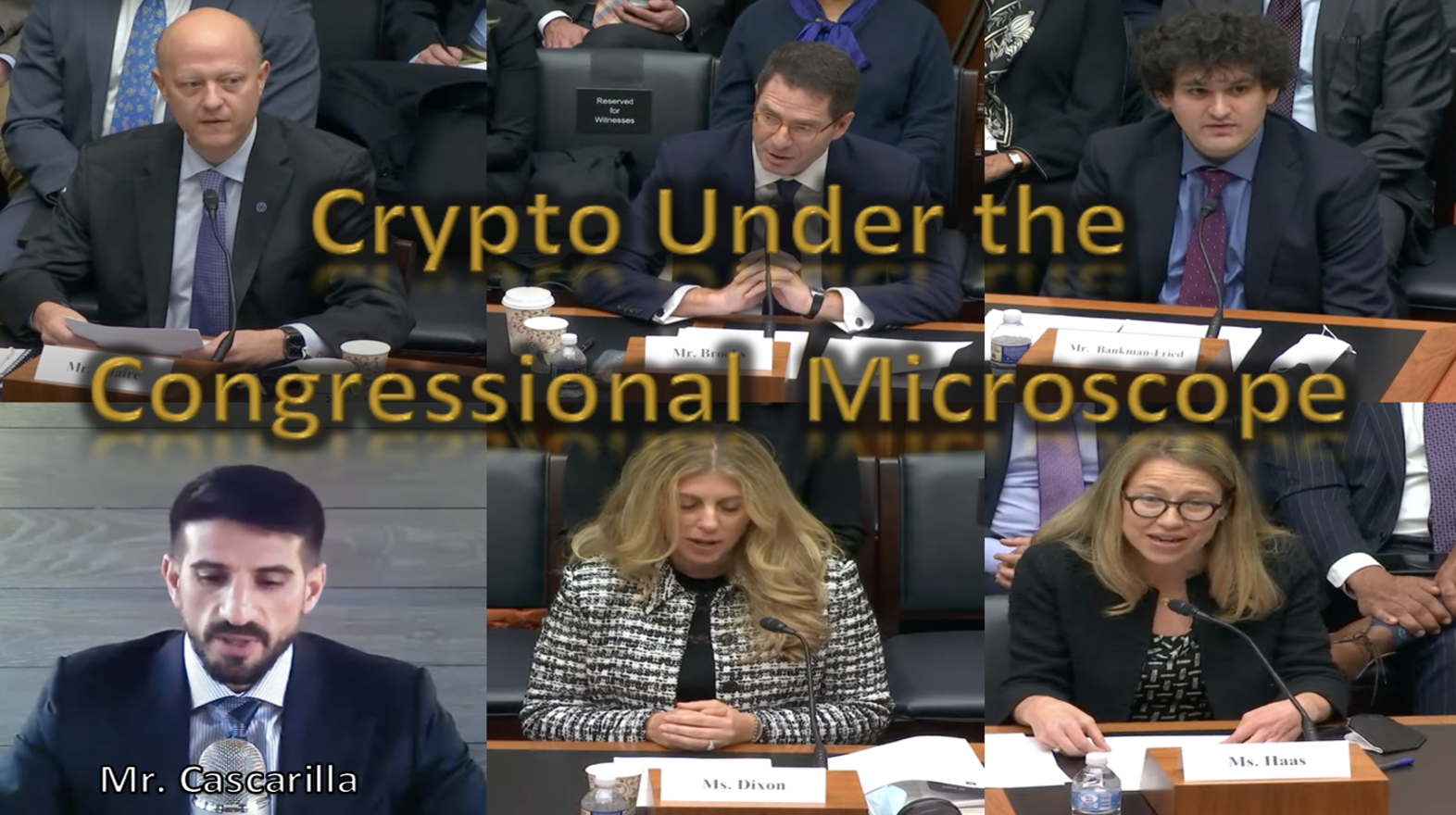

Notably absent from the below panel was a representative from Tether, the largest U.S. dollar backed stablecoin, whom recently had to payout 41 million in fines for misleading the public. Also absent was the invited attendee Brian Armstrong of Coinbase, represented instead by Coinbase’s CFO Alesia Haas.

The panel of leading blockchain experts questioned during the hearing consisted of Jeremy Allaire, co-founder and CEO of Circle (creator of the stablecoin USDC); Samuel Bankman-Fried, founder and CEO of FTX (a cryptocurrency exchange); Brian Brooks, the former U.S. chairman of the Office of the Comptroller of Currency and current CEO of Bitfury (a diversified blockchain company); Charles Cascarilla, CEO and co-founder of Paxos, which like USDC is a U.S. dollar backed stablecoin; Denelle Dixon, CEO of the Stellar foundation, whom oversees the cryptocurrency Stellar Lumens, which specializes in the instant exchange of value between institutions; Alesia Haas, CFO of Coinbase, the publicly traded leading cryptocurrency exchange.

A common theme among the panelist was Web 3.0 and the plead for U.S. lawmakers to see beyond crypto and blockchain technology as merely a financial instrument; Mr. Brooks summed it up best:

Treating crypto as a single unitary activity whose main feature is a need for financial regulation, would be like treating the original internet back in the 1990s as a tax policy issue, we didn’t do that then.

Mr. Brooks then goes on to ask:

Do we believe a user controlled decentralized internet is better than an internet controlled by five big companies?

The answer to this question is an obvious yes, and it is an eye-opener.

The purview of congressional leaders hitherto has focused solely on crypto as a financial instrument without considering decentralized blockchains’ ability to secure the un-secured internet of today, which is owned by Big Tech. Through cryptocurrency, we can transform today’s hacked internet into a highly secure, decentralized network owned by We the People. Much like the early 1990’s, the United States is at a crossroads whereby we can take a leadership role by ensuring the crypto industry is protected, but not overregulated.

And this time around, We the People stand to benefit most from truly decentralized blockchains, rather than Big Tech, which is what makes this such a historic crypto hearing.

The underbanked’s and the unbanked’s accessibility to groundbreaking blockchain tech was also highlighted. Congressman Ritchie Torres voices his concerns:

I represent the South Bronx, which is often said to be the poorest congressional district of American, and of the greatest concern to me are use cases of crypto that will improve the lives of the people of the South Bronx. I represent a population of immigrants who often pay heavy predatory fees in order to send remittances to their loved ones abroad. So, what can crypto-blockchain-Web 3.0 do for that Dominican immigrant in the South Bronx.

Mr. Cascarilla of Paxos answers:

The technology is open to anybody. You do not need to have a bank account; you do not need to rely on an intermediary. So, somebody who is an immigrant and wants to send a remittance to a foreign member of our country is able to do that. And there are ways to do it [with both] crypto and with stablecoins. All you need to do is download a wallet and send it to somebody else anywhere in the world. This is a really powerful tool for the democratization of access, especially those who have difficulty getting bank accounts. There are no minimum check cashing fees… you can do this for a penny or less… 24 hours, 7 days a week, 365 days a year instantaneously… with no multiday lags.

On the topic of stablecoins, Mr. Hollingsworth representing Indiana, asks of Mr. Allaire:

Explain to me the valuation proposition to me owning a stablecoin that can convert into dollars as opposed to owning the dollars themselves.

Mr. Allaire responds:

I think it’s good to use analogies sometimes on this, it’s the difference between having a postal letter verses an e-mail. A digital version of a letter can move at the speed of the internet to anyone for free. It’s an upgrade to the functionality of a letter… digital currency dollars inherent the superpowers of the internet, the speed, the reach, the interoperability, and so on. Well-defined stablecoins are safer than bank deposits, because with bank deposits you are taking a risk on the lending books of the underlying bank. So, you have run risks; default risks on all the loans that sit in a bank. A full reserved form of money, which is what a digital dollar represents is actually a safer transactional medium.

Mr. Hollingsworth goes on to ask:

Why can’t the same technology that runs stablecoins run the payment system in dollars; won’t we eventually cut out the middle step of having to convert to a stablecoin and then transact in this frictionless and speedier environment, won’t we eventually figure out how to run that through the existing payment system?

Mr. Allaire responds:

I think in some ways it’s a question of semantics, when I use the IOU settlement system of a visa card, I am not actually spending dollars per say, there are a bunch of IOUs on a centralized ledger that are keeping track of things and ultimately underneath there is a Fed wire that goes from one bank to another. We experience it [the transactions] as a card. There is this whole elaborate system underneath that [card] that charges fees. What we see is that well-regulated stablecoins are upgrades to those kinds of payment systems.

Essentially, Mr. Hollingsworth was referring to a CBDC replacing stablecoins. And Allaire’s response calls to mind that our entire banking system runs on such payment systems. So, the development of CBDC wouldn’t just eliminate stablecoins as the middleman… every modern-day payment system is also a middleman, which is exactly why peer-to-peer payments are so revolutionary.

But if we think about American capital markets and what keeps the United States on the cutting edge, it is because the U.S. government champions corporations like Visa to thrive and compete. Circle, through its USDC crypto has created a better payment system through blockchain tech. If the U.S. government goes the route of creating a CBDC, it will be entering the competitive arena of all other payments systems as well: American Express, MasterCard, and even more modern systems like Square’s Cash app or Paypal. It is not within U.S. interests to compete on such a stage.

Another key element to consider is that stablecoins right now are in their early evolutionary stage. Crypto is programmable money. There will be advanced iterations of stablecoins where innovation will matter. And I assure you, a CBDC run by governments will not be able to effectively compete keep pace with the innovations on public blockchains back by American entrepreneurs, nor will the government agencies administering to such a token attract the best talent.

The subject of Bitcoin’s role was mostly absent from the hearing, except toward the end when congresswoman Rashida Tlaib pointed-out that one Bitcoin transaction uses the same amount of electricity that an American U.S. household uses in a month. After reviewing this article link that I believe she was referring to, I don’t see how it’s possible to arrive at the article’s conclusion when millions of transactions are now settled through second layer solutions like the lightning network. These transactions take place off-chain and at a fraction of the cost before being settled on the Bitcoin main-chain. There is an amplitude of transaction taking place that may not be reflected in these findings. At best, I believe her statement is misleading and doesn’t account for the full value that the Bitcoin network generates.

From another perspective… Bitcoin miners are able to mine Bitcoin at a profit. These miners also use electricity. If the cost to secure the network through mining exceeded the electricity cost of the network, Bitcoin mining would not be profitable. But because the Bitcoin network has value more than the electricity to produce, it is mined at a profit.

Likewise, as a digital store of value, Bitcoin is more efficient than traditional stores of value: assets such as gold, silver, etc., or precious items inside an actual safe or safety deposit box, and even real estate, or any other form of a safeguarded asset. The ease-of-use to manage and transfer value in Bitcoin far exceeds the time and money it takes in these traditional forms.

Another way Bitcoin provides value is through the Stacks token built on the Bitcoin blockchain., It allows for smart contract programming on the Bitcoin network, which is essentially helping to transform Bitcoin into its own internet secured by cryptography. Conceivable, the value of such a future network is in the hundreds of trillions of dollars.

Bitcoin did not have representation at the hearing, and considering Ms.Tlaib directed her admonition of Bitcoin to Dixon, who oversees the Stellar blockchain, which is essentially a competitor to Bitcoin, Tlaib found an agreeable response.

Rashida posed following question:

Can you explain why a cryptocurrency current, like Bitcoin, that relies on proof-of-work mining is such an energy intensive process?

Ms. Dixon responded:

The way that Bitcoin consensus is achieved is through really complicated math equations and so there is a lot of energy that is needed to be used to make that happen… the stellar consensus can be done on a really small computer, like the one right in front of you… the consumption of energy on Stellar is really low… it’s less than the consumption of Visa [per transaction].

In lieu of Ms. Dixon’s statement, one compares Bitcoin to other blockchains in terms of security and decentralization. Blockchains give up decentralization characteristics when aiming for higher transaction speeds and network agility; therefore, there is a cost to non-proof-of-work algorithms. What do other blockchains give up in terms of decentralization and security when applying new algorithms to achieve lower energy cost? And are these other blockchains flexible enough to unlock Web 3.0’s amazing potential.

The costs may outweigh the benefits. Congressional leaders must be aware that we are not just talking about a financial system, we are talking about an internet that is 10x better than the internet today, as it will be secured by cryptography.

Mr. Foster of Illinois, a member of Congress with a technology background, raised the concerns over establishing a digital identity to hold any conducting illegal activity accountable. He has been vocal about tying identity to ownership in the past, and in his questioning, he put the panel on the spot:

I’d like to focus on what I think is of crucial importance of having a secure digital identity for crypto asset transaction. First, regarding controlled anonymity for prevention of criminal activities, it seems to me if we wish to prevent crypto assets from being used, for example, for ransomware or other criminal payment, then there is no logical alternative than to having all crypto transactions associated with a legally traceable identity. Someone who can be extradited if they do something criminal. These can be pseudonymous to market participants and the public, but they must be capable of being de-anonymized to the court in a trusted jurisdiction. Do any of you agree with that conclusion?

No one on the panel objected.

What Mr. Foster is proposing is possible through a technology called Z-Snarks. Z-Snarks can keep chosen information private on a blockchain, yet also allow for certain information to be revealed. The problem with his proposal is that some sort of key would have to be retained by a central entity, in this case the U.S. government, to unlock the information when needed. This means that the owner of the crypto would not be the only holder of the key. It would also be held by a centralized entity. This proposal is what crypto enthusiasts are seeking to avoid, which is a centralized commander having access to information.

Granted, the information would only be accessible through a court order. But the access key would have to be held somewhere. And it would transform a decentralized system into a centralized system that is vulnerable to attack, should these access keys be obtained through a hack (and we certainly know that governments too are vulnerable to hacks).

So, I was surprised to see the panel remain silent after the question was asked. It may have been more appropriate to ask each panel member individually to get a more meaningful response. Also, the question was framed in such a way that by disagreeing, you are supporting criminal activity. This certainly isn’t the case.

Crypto is not the only means to catch criminals. There are many other ways to investigate criminal activity and find the culprits outside of the blockchain itself.

Here is an alternative: Rather than imbedding into blockchains a way for governments to surveil crypto, why not instead use the technology to protect sensitive data? The ransomware attack Mr. Foster is referring to would not be possible if our systems were adequately secured with blockchain technology. This is the more agreeable way forward.

Throughout most of the testimony, it was the favorable aspects of crypto that were championed and discussed.

Mr. Rose asks Mr. Bank-Fried,

Could you tell us about the economic impact, from your perspective, that FTX U.S. has in this country?

Mr. Bank-Fried responded:

In addition to obviously the impact in terms of the hiring that we are doing and the support of a number of initiatives in the country related to job training and education, we’re also hoping that we can help provide financial services to people who have not had easy access to those before.

And there it stands. Blockchain tech is not only creating jobs across the nation, it’s also allowing for greater finance access to those who have not had the means to do so.

The committee hearing was an overall success. Congressional leadership was mostly concerned about the United States remaining in the vanguard of blockchain tech. For the most part, the inquiries were genuine attempts to understand the nuances of this industry, rather than casting predetermined judgments.

Mr. Allaire gave the committee much to think about in terms of stablecoins and creating a CBDC. Throughout the hearing, it became apparent that even if the U.S. government decided to create such a coin… it would be putting itself in a competitive position with the entire financial industry. This observation alone will raise plenty of flags among U.S. leadership as very few in Congress would risk losing their constituency. They will not advocate for the United States to blatantly compete with the very corporations that fund their campaigns (broken as it may be—occasionally, such an unfortunate reality regarding campaign finance law leads to a favorable outcome).

Also, a U.S. CBDC will be unable to keep pace with American innovation. Therefore, the hearing has allayed some concerns over a globalist agenda to create CBDC, whereby the U.S. government will surveil our every activity.

But we must all remain vigilant and continue hold power in check over these matters. As the ripple effects of improper blockchain regulation can change the entire course of history.